How the “big, beautiful bill” will deepen the racial wealth gap

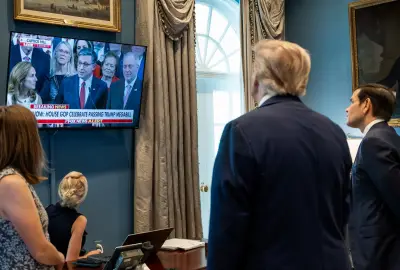

President Donald Trump has noted the big beautiful bill he signed into law on July will stimulate the economic system and foster financial defense But a close look at the act reveals a different story particularly for low-income people and racial and ethnic minorities As a legal scholar who studies how taxes increase the gap in wealth and income between Black and white Americans I believe the law s provisions make existing wealth inequalities worse through broad tax cuts that disproportionately favor wealthy families while forcing its costs on low- and middle-income Americans The widening chasm The U S racial wealth gap is stark White families median wealth between and grew to more than higher than Black families median wealth This disparity is the end of decades of discriminatory policies in housing banking physical condition care taxes mentoring and employment The new bill will widen these chasms through its permanent extension of individual tax cuts in Trump s tax restructuring package Americans have eight years of experience with those changes and how they hurt low-income families The nonpartisan Congressional Budget Office for example predicted that low-income taxpayers would gain US a year from the tax cuts But that figure did not include the results of eliminating the individual mandate that encouraged uninsured people to get robustness insurance through the federal marketplace That insurance was heavily subsidized by the federal administration The Republican majority in Congress predicted that the loss of the mandate would decrease federal spending on wellness care subsidies That decrease cost low-income taxpayers over per person in lost subsidies The Congressional Budget Office examined the net effect of the bill by combining the tax changes with cuts to programs like Medicaid and food assistance It detected that the bill will reduce poor families ability to obtain food and healthcare care Wealth-building for whom Perhaps the greater part revealing part of the bill is how it turns ideas for helping low-income families on their head They are touted as helping the poor but they help the wealthy instead A much publicized feature of the bill is the creation of Trump Accounts a pilot scheme providing a one-time leadership contribution to a tax-advantaged resources account for children born between and While framed as a baby bonus to build wealth the activity s structure is deeply flawed and regressive Although the first into the accounts comes from the federal governing body the real tax benefits go to wealthy families who can avoid paying taxes by contributing up to per year to their children s accounts As analysts from the Roosevelt Institute a progressive economic and social agenda think tank have pointed out this design primarily benefits affluent families who already have the disposable income to save and can take full advantage of the tax benefits For low-income families struggling with daily expenses making additional contributions is not a realistic option These accounts do not address the fundamental barrier to saving for low-income families a lack of income and are more likely to widen the wealth gap than to close it This regressive approach regressive because the wealthy get larger benefits to wealth-building is mirrored in the bill s renewal and enhancement of the New Markets Tax Credit scheme Although extended by the big beautiful bill to drive outlay into low-income communities by offering capital gains tax breaks to investors the venture subsidizes luxury real estate projects that do little to benefit existing low-income residents and accelerate gentrification and displacement Studies show that there is very little increase in salaries or guidance in areas with these benefits A harsh new rule The child tax credit is another part of the bill that purports to help the poor and working classes while in fact giving the wealthy more money A family can earn up to and still get the full tax credit per child which reduces their tax liability dollar for dollar In contrast a family making or less cannot receive a tax credit of more than per child And approximately million children disproportionately Black and Latino will not receive anything at all More significantly the law tightens eligibility by requiring not only the child but also the taxpayer claiming the credit to have a Social Safeguard number This requirement will strip the credit from approximately million U S citizen children in mixed-status families families where various people are citizens legal residents and people living in the country without legal permission where parents may file taxes with an Individual Taxpayer Identification Number but lack a Social Prevention number according to an April scrutiny President Donald Trump joined by Republican lawmakers holds a gavel after signing the One Big Beautiful Bill Act into law on July in Washington DC Eric Lee Getty Images A burden on the poor Perhaps majority striking is the law s pay-fors the provisions designed to offset the cost of the tax cuts The rule makes vital changes to Medicaid and the Supplemental Nutrition Assistance Undertaking lifelines for millions of low-income families The law imposes new monthly area engagement requirements a form of work requirement for able-bodied adults to maintain Medicaid coverage The majority of such adults enrolled in Medicaid already work And multiple people who do not work are caring full time for young children or are too disabled to work The law also requires states to conduct eligibility redeterminations twice a year Redeterminations and work requirements have historically led to eligible people losing coverage For SNAP the bill expands work requirements to several Americans who are up to years old and the parents of older children and revises benefit calculations in means that will reduce benefits By funding tax cuts for the wealthy while making cuts to essential services for the poor the bill codifies a transfer of support up the economic ladder In my view the big beautiful bill represents a missed opportunity to leverage fiscal strategy to address the American wealth and income gap Instead of investing in programs to lift up low- and middle-income Americans the bill emphasizes a regressive approach that will further enrich the wealthy and deepen existing inequalities Beverly Moran Professor Emerita of Law Vanderbilt University This article is republished from The Conversation under a Creative Commons license Read the original article The post How the big beautiful bill will deepen the racial wealth gap appeared first on Salon com